该消息已经发布:拜登总统授权高级儿童税收抵免,许多父母已经在其银行帐户中收取付款。但是,关于2021年儿童税收抵免计划有什么大不了的?而且,您为什么要以企业主的身份知道这一点?我们已经获得了儿童税收抵免的勺子,以及如何使您和您的员工受益。

What is the child tax credit?

The IRS child tax credit is a tax benefit for American taxpayers who have qualifying dependent children. This tax credit decreases the tax liability for taxpayers on a dollar-for-dollar basis. In addition, child tax credits are based on income taxes, not工资税.

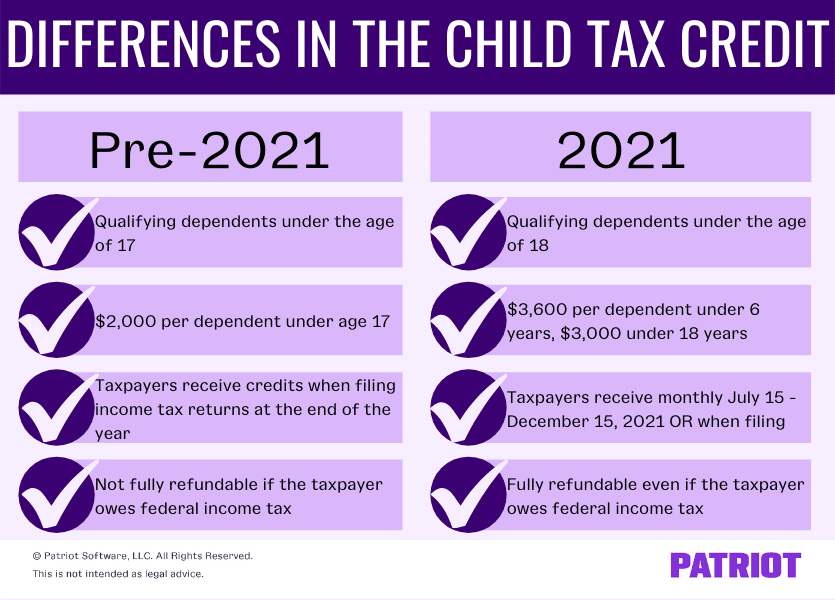

自1997年以来,儿童税收福利减少了纳税人在今年年底所欠的税款。在1997年至2021年之间,联邦政府几次改变并扩大了收益。在2021年,响应1921年的福利暂时改变了。

Child tax benefit pre-2021

Before 2021, taxpayers could claim qualifying dependents if the dependent met specific conditions, including:

- Being under the age of 17 by December 31 of the applicable tax year

- Being a taxpayer’s child (biological or adopted), stepchild, eligible foster child, brother, sister, step-sibling, half-sibling, or a descendant of any of those (e.g., grandchild)

- 在纳税年度的一半以上与纳税人一起生活*

- The dependent not paying for more than half of their living expenses for the year

- 被认为是纳税人所得税申报表的依赖

- Not filing a joint tax return with the taxpayer

- 作为美国公民,美国国家或美国居民外国人

*The government considers a child to have lived with the taxpayer for more than half of the tax year if the child was born or died in the tax year and lived with the taxpayer for half of the time they were alive.

Child tax credit 2021

的一部分American Rescue Plan(ARP), the expanded child tax credit is temporary for 2021. Notable changes to the tax credit include:

- Child tax credits are fully refundable, regardless of how much taxpayers owe on their 2021 taxes

- An increase in the benefit from $2,000 to $3,600 for children under the age of six and $3,000 for children under the age of 18

- No cap on the credit amounts taxpayers can claim if the filer has multiple children

- 现年18岁以下的儿童现在包括在税收抵免中*

- Eligibility for receiving advance tax payments between July 1, 2021 and December 31, 2021

*在2021年扩张之前,儿童税收抵免额涵盖了17岁以下的家属。

Parents with eligible dependents can choose to wait until they file their 2021 tax returns to receive the entirety of the child tax benefit. Or, taxpayers can elect to receive payments on the 15th of every month, starting on July 15, 2021 and through December 15, 2021.

选择每月分期付款的纳税人在提交所得税申报表时会在直接付款中获得一半的税收福利。

The child credit 2021 plan includes a special lookback period. Typically, the IRS calculates the credit based on the current year’s tax returns. However, COVID-19 impacted the average income for many families. So, the IRS allows taxpayers to determine their tax credit based on 2019 income. The provision benefits those whose 2020 income may make them ineligible for the expanded credit.

收入$ 0的父母还可以根据2021年计划获得每月儿童税收抵免额的资格。通常,付款是自动的,纳税人必须选择退出其纳税申报表的付款。尚未申请2019年纳税年度或2020年纳税年的看护人和父母必须注册以获得那年的税收抵免。

Why is the child tax credit important?

When the child tax credit went into effect in 1997, the purpose was to help ease the financial burden of raising children.

Under the original benefit law, taxpayers received the credit when filing taxes. Credits either reduced the amount of taxes owed or gave taxpayers a refund. The 2021 child tax credit stimulus goes further and provides direct relief to families in payment installments.

So, why is the tax credit important? The purpose of the tax credit is to assist low and middle-income earners with the costs incurred from raising children. The American Rescue Plan expanded child tax credit stimulusestimates a 45% reductionin the number of children living in poverty.

The new rules aim to reduce the impact of the COVID-19 pandemic on families who have lost jobs or had their working hours reduced.

How can the child tax credit benefit employers?

Now that we’ve covered what the tax credit is, you may be asking how this can benefit you as an employer. While it’s true that the new child tax credit benefits workers and their families individually, there are some benefits for businesses, too. Specifically, the benefits are for business owners who meet the criteria for the child tax credit.

您可能无法将儿童税收抵免额添加到企业的书籍中,但是您可以使用税收抵免来使您个人受益。而且,这些好处进入了您的工作生活。

例如,您可以使用儿童税收抵免刺激付款来支付日托。许多雇主都不是什么秘密struggling to maintain enough of a workforce充分运作。作为所有者,因此您可能每周都会投入更多的工作时间。

如果您有孩子,他们可能需要在工作时参加日托或课后课程。您可以使用儿童税信用支付来支付日托或孩子的计划。而且,为您工作的员工可以选择做同样的事情。

| Need a simple solution to streamline your books? Patriot’s onlinevwin055 makes it as easy as 1-2-3. Start your FREE 30-day trial today! |